Starbucks vs China’s Luckin Coffee

Starbucks confidently explained to investors during the weeks before it debuted, that Chinese rival Luckin Coffee’s BlackRock-backed IPO will not derail 20 years of market dominance.

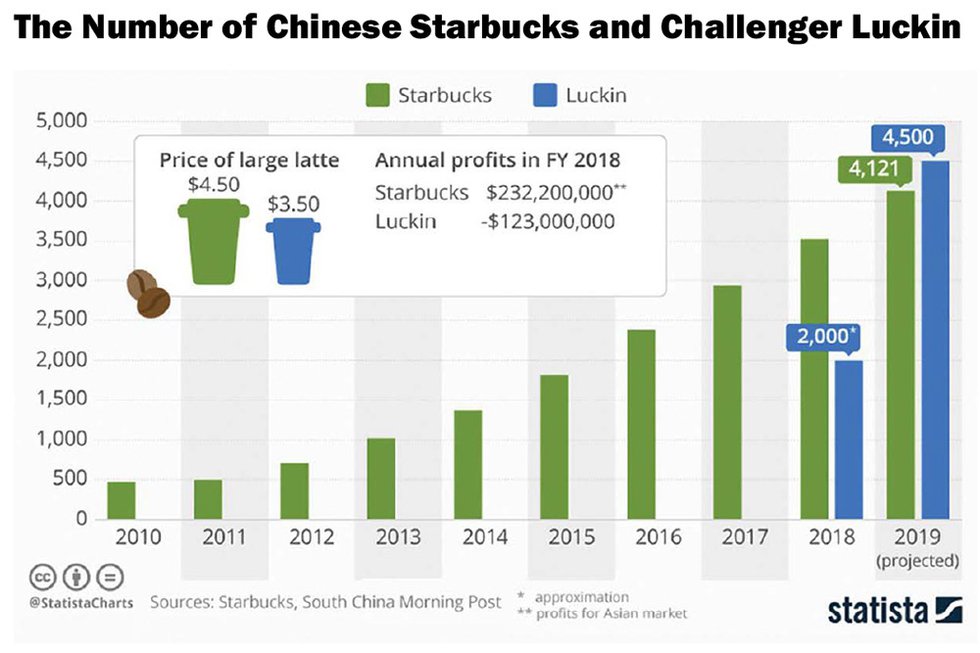

The initial public offering in New York (Nasdaq) valued the company at $3.9 billion, raising $561 million in the US at a share price of $17. This financing will enable Luckin to open 4,500 stores by year-end, surpassing Starbucks which anticipates a year-end total of 4,121.

Starbucks c.e.o. Kevin Johnson reassured investors that a strategy based on heavy discounting is not viable. He also stepped up Starbucks delivery. Luckin, owned by two rental car entrepreneurs, received $550 million in seed money and grossed $125 million in 2018 while reporting a $238 million loss since launching in October 2017.

The delivery-focused Luckin is now China’s second largest chain and going public after only 19 months. The company is opening an average three storefronts per day, growing locations by 18% to 2,550 shops during the first quarter of 2019, according to company documents shared by Thinknum Media, a data resource for journalists.

Thinknum founder Justin Zhen provided STiR with unique insights into the distribution of Luckin locations. These were plotted against existing Starbucks locations block by block (see maps).

In Shanghai, the rivals are located as close as 50 feet. Luckin only accepts digital orders and guarantees delivery in 30 minutes at prices well below Starbucks. Drinks are comparable in taste and brewed with similar equipment. With 90 million cups sold to 17 million customers, the data-driven venture is both gaining and retaining customers.

Zhen observed that the concentration of locations is densely urban, in contrast to Starbucks which now has a greater presence in Tier 2 and Tier 3 where coffee shops are more of a destination. China ranks its top 338 cities by population and economic clout. There are 30 Tier 2 cities such as Xiamen (Amoy), Kunming, and Fuzhou. Starbucks has much deeper penetration than Luckin in several of these markets.

Starbucks is also present in Tier 3. The city of Xining in Qinghai province is the farthest western location for Starbucks, according to Zhen. Nyingchi in Tibet is the western-most city with both a Starbucks and Luckin location. There are no Luckin shops in Hong Kong or Taiwan. Starbucks operates 174 stores in Hong Kong and 454 in Taiwan with 682 in Shanghai, compared to Luckin’s 355 Shanghai locations.

Luckin, however, operates more stores than Starbucks in Beijing, Guangzhou, and Shenzhen. Luckin located more than half of its stores within a five-minute walk of existing Starbucks locations.

Fundamentally Starbucks operates cafes while Luckin is a tech-savvy coffee delivery service collecting great quantities of data. The greatest danger to Starbucks is not Luckin, it is the introduction of convenient low-cost coffee.

The Chinese consume about 6.2 cups of coffee per capita, far less than the 300-400 cups per capita in the US and European countries. Consumption is expected to triple in China during the next three years. While Starbucks holds 58% of the coffee market by value Luckin is quickly eroding that dominance.

Lower Map courtesy Justin Zhen / Thinknum